Your Employees Deserve to Be Financially Sound

Financial Literacy as a Benefit

Offering a life literacy program equips employees with essential skills and the knowledge to improve their personal and professional capabilities.

Increased productivity Enhanced problem-solving abilities Boosted employee confidence

Employee Resources

Utilize any of the available Banzai resources to build a custom support system that boosts the financial wellness of your employees.

Wellness Center

The Wellness Center is a customizable education platform that covers all the gaps in your employees’ financial knowledge, from the moment they’re hired to the date they retire.

Articles on the importance of 401ks, health insurance, and more Calculators to help with important life decisions like buying a home Employee assessments

The Banzai Coach

This feature walks employees through financial- & life-centered dilemmas with advice tailored to their unique situations. Cover topics like

Debt management HSA & FSA benefits Retirement

Employee Pages

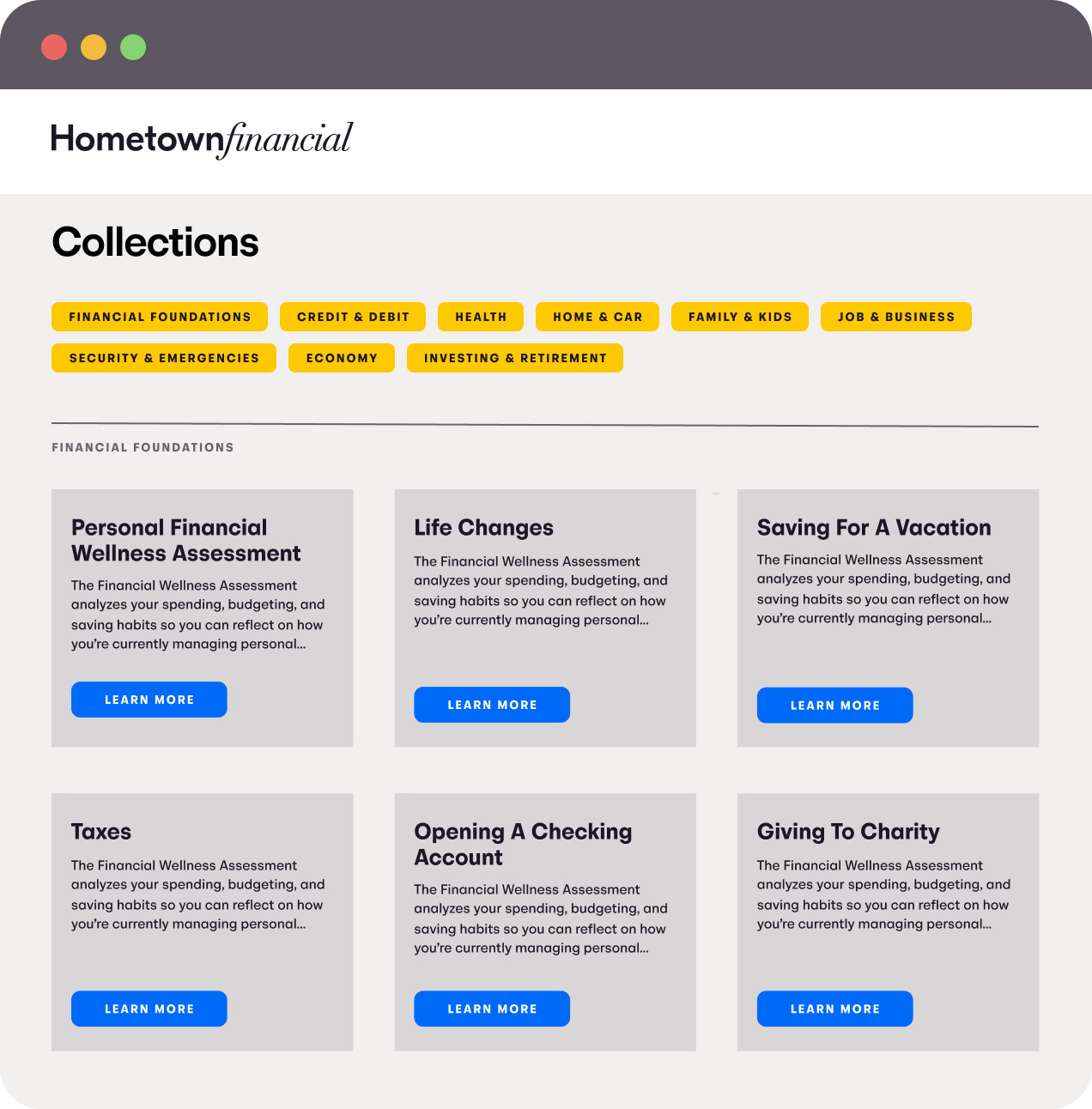

Choose from a library of over 150 life literacy resources within the Wellness Center to build your very own employee-focused training program.

40 pre-built collections Customizable Co-branded partner pages

Employee Offers

Offer incentives to your employees for completing Banzai resources.

Place incentives throughout courses for employees to find as they play. Include links to resources and services. Add offers to Coaches.